Stock Average Calculator

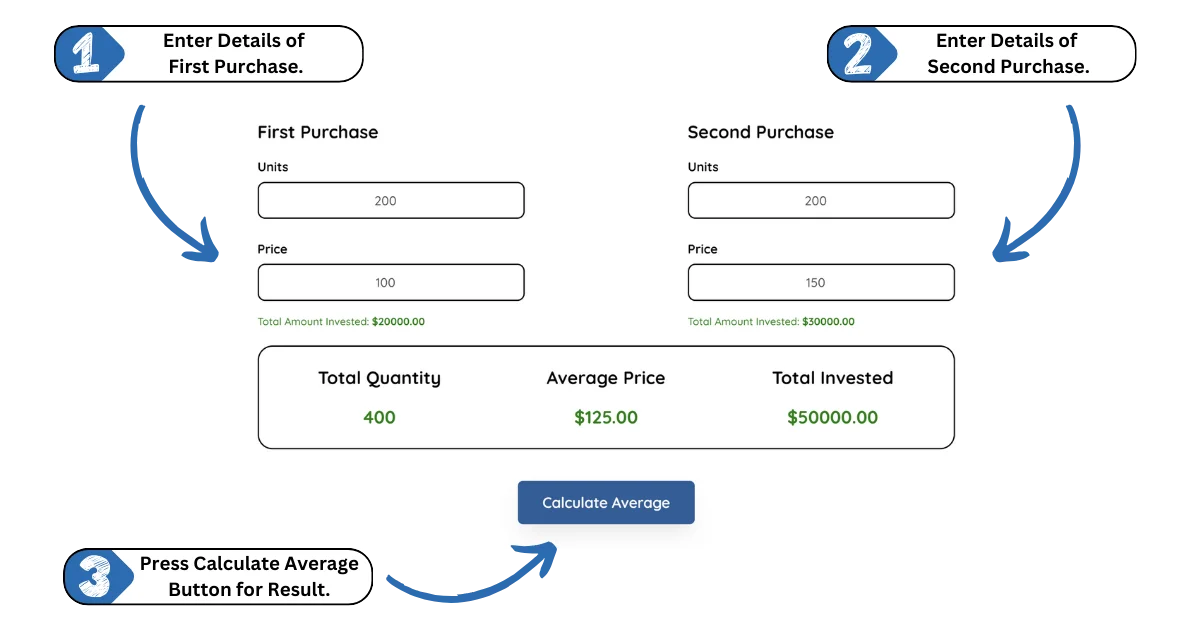

Our Stock Market Average Calculator is your go-to tool for making informed decisions about your portfolio.

Simply input your first purchase and second purchase quantity and price, and let our calculator do the rest. It’s that easy!

How to Calculate Stock Average?

Calculating your stock average is a breeze with our user-friendly tool. Here’s a step-by-step guide:

- Gather Your Data: Collect all your stock purchase information. This includes the price you paid and the number of shares for each buy.

- Enter the Information: Input this data into our calculator. Don’t worry, it’s as easy as filling out a simple form!

- Click Calculate: Hit that magic button and watch the math happen instantly.

- Review Your Results: The calculator will show you your average stock price, total quantity purchased, and total investment.

Average Stock Price = Total Cost of Purchases / Total Number of Shares

Where:

Total Cost of Purchases = Sum of (Price per Share × Number of Shares) for each purchase

Total Number of Shares = Sum of (Number of Shares) for each purchase

Let’s break it down with an example:

Significance of Stock Market Averaging

Why should you care about your average stock price? Let’s dive deeper into the reasons why knowing your average stock price is crucial for wise investing:

1. True Investment Picture

Understanding your average stock price gives you a crystal-clear view of your investment position. This number tells you exactly how much you’ve invested per share, regardless of market fluctuations. Whether you’ve been buying stocks for years or just started, this single figure shows your entire investment history for that stock.

2. Smart Decision-Making

Your average stock price is a powerful tool for making informed investment decisions. It serves as a personal benchmark for each stock in your portfolio. Here’s how:

- If the current market price is significantly below your average, it might be a good opportunity to buy more shares and lower your overall average cost. This is often called “averaging down.”

- If the market price is well above your average, you might consider taking some profits by selling a portion of your shares.

- It helps you set realistic price targets for buying or selling based on your actual investment, not just market sentiment.

3. Performance Tracking

Comparing your average price to the current market price is the quickest way to gauge your investment’s performance. It’s like having a scorecard for each stock you own. For example:

- If you bought shares at an average of $50, and they’re now trading at $75, you know you’re up 50% on that investment.

- This makes it easy to compare the performance of different stocks in your portfolio, helping you identify your winners and losers at a glance.

4. Emotional Control

The stock market can be an emotional rollercoaster, but your average stock price can be your emotional anchor. Here’s why:

- Daily price fluctuations can cause stress and lead to impulsive decisions. Your average price provides a steady reference point.

- If your stock drops 5% in a day but is still well above your average price, you can reassure yourself that you’re still in a good position overall.

- This perspective can help you stick to your long-term investment strategy instead of reacting to short-term market noise.

5. Tax Calculations

Come tax season, your average stock price becomes your best friend. Here’s how it helps:

- When you sell shares, you need to calculate your capital gains or losses. Your average price is the cost basis for this calculation.

- If you’ve bought shares at different times and prices, knowing your average makes it much easier to determine your overall gain or loss.

- This information is crucial for accurately reporting your investment income and potentially minimizing your tax liability.

Remember, while the current market price of a stock can change by the second, your average price is a stable figure that changes only when you make new purchases. It’s your personal scale for measuring investment success and making sound financial decisions.

Frequently Asked Questions

What exactly is stock averaging?

Stock averaging is the process of finding the average price you’ve paid for a stock over multiple purchases. It’s like finding the “typical” price of all your buys, giving you a clear picture of your overall investment.

How often should I recalculate my stock average?

It’s a good practice to recalculate after each new purchase. If you’re not buying frequently, doing it monthly or quarterly can help you stay on top of your investments.

What's the difference between average cost and market price?

our average cost is what you’ve typically paid per share across all your purchases. The market price is what the stock is currently trading for. Comparing these can help you see if you’re currently in profit or loss.

How does stock averaging relate to dollar-cost averaging?

Dollar-cost averaging is a strategy where you invest a fixed amount regularly, regardless of share price. Stock averaging helps you see the average price you’ve paid when using strategies like this.

How does stock averaging help with risk management?

By knowing your average price, you can set stop-loss orders more effectively and make informed decisions about when to buy more or sell to manage your risk.

How does knowing my average affect my investment strategy?

Understanding your average price can help you make more informed decisions. For example, if the current price is below your average, you might consider buying more to lower your overall average cost.

Popular Topics

Why Time Frame Selection in Stock Averaging Matters

Unlock the secrets of time frame selection in stock averaging to maximize profits and enhance your trading strategy.

Simple Moving Average vs Exponential Moving Average

Getting the Hang of Moving Averages Moving averages are like the secret sauce in stock trading, helping traders figure out price trends over time. The

What is the Weighted Moving Average in Trading

Explore the weighted moving average for smarter trading. Learn calculation, application, and strategies for better decisions.